If you are onboarding traders, collecting debt, refinancing loans, or resolving payment disputes, your team needs a secure, compliant communication platform designed for scale. Squaretalk is built exactly to meet the needs of fintech companies in:

Don’t compromise on security, compliance, or customer experience

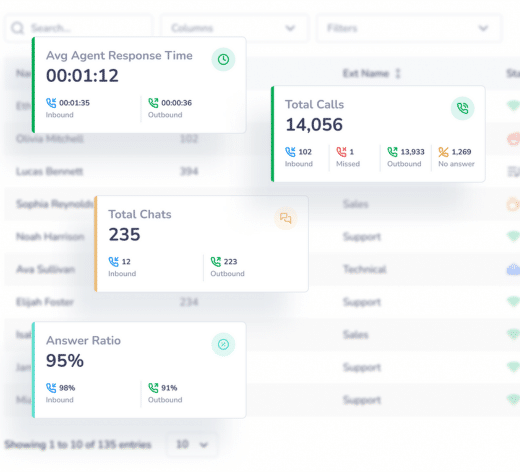

Win new clients with credit card offers, refinancing opportunities, mutual funds, or ETFs. Run high-volume sales campaigns with predictive dialing, local numbers, AI insights, and CRM integrations – built to maximize talk time and conversion across projects.

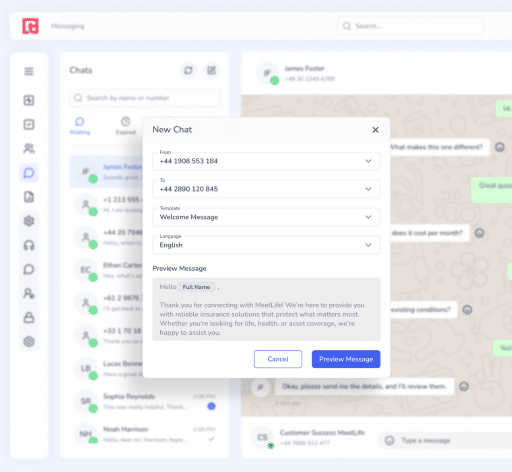

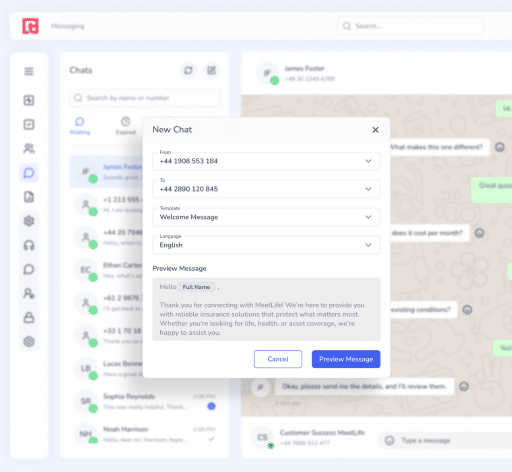

Maximize the efficiency of collections by filtering out answering machines and busy signals, and connecting agents only when a human answers. Use AI voice agents, WhatsApp templates, and SMS to automate payment reminders.

Prevent churn by acting on risk signals (e.g., account cancellation requests, loan early payoffs, repeated support contacts, missed payments). Route clients to trained agents and leverage customer data, sentiment analysis, and dynamic scripts.

Handle high volumes of balance checks, transaction history, password resets, card activation, blocking, or replacement requests. Automate routine inquiries with AI voice agents and provide more self-service options with IVRs.

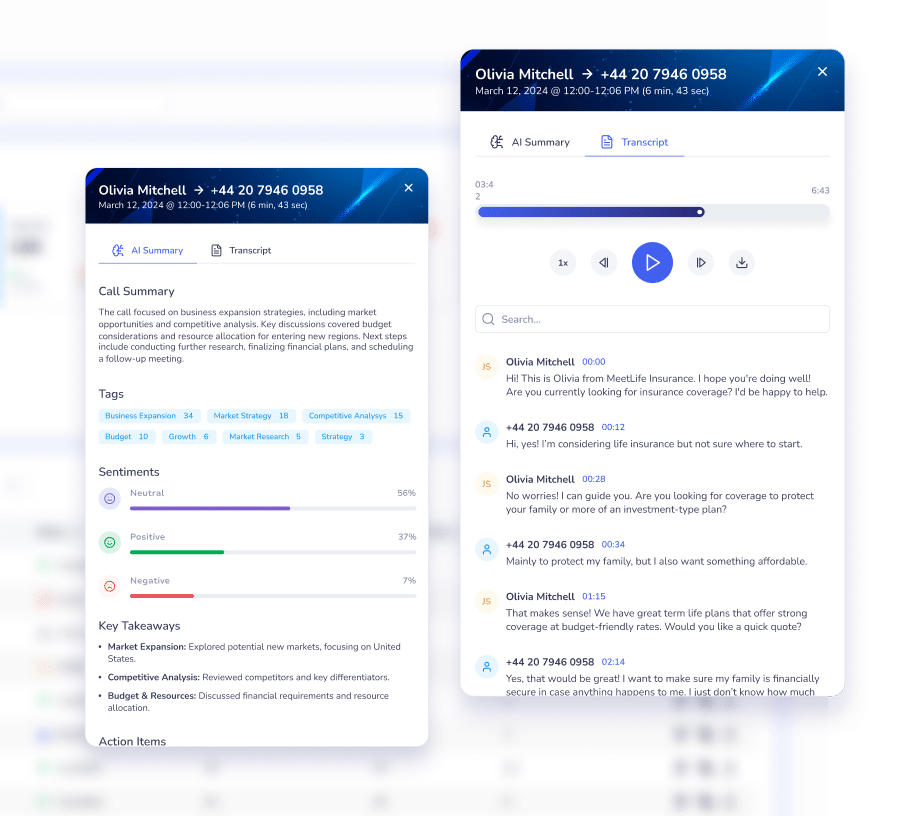

Record calls, monitor transcripts, and maintain full audit trails to comply with regulations and industry standards like GDPR, SOC 2, PCI DSS, TCPA, and AML. Include recorded legal disclaimers in IVR flows or during calls.

Verify suspicious activity, send real-time fraud alerts, and help customers secure compromised accounts. Squaretalk ensures secure communication for customers to confirm or dispute transactions.

Empower your Team to Achieve More

Secure and Audible Trading Communication

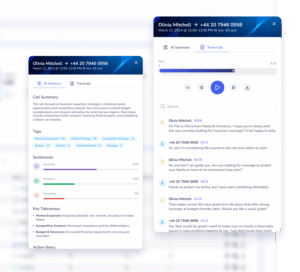

Ensure no time-critical calls and WhatsApp conversations (e.g., trade executions, order management, account access, trading restrictions) are delayed or disconnected. Prioritize high-net-worth clients and specialized inquiries by routing them to the right licensed broker. Use AI transcripts and sentiment analysis to flag forbidden phrases, potential coercion, or panic selling.

Automated and Compliant Recovery

Reach more debtors without violating compliance regulations, time-zone restrictions, or frequency limitations. Segment accounts by delinquency stage and prioritize those with higher recovery probability. Offer self-service options, automations, and multi-channel payment reminders to increase collection rates and resolve cases independently.

Improved Speed-to-Lead and Risk Validation

Confirm loan terms, handle rollover and extention request, and resolve disbursement issues quickly and at scale. Proactively follow up on pending or failed payments via phone, WhatsApp, and SMS, and keep detailed records of every interaction, authorization, and disclosure. Identify borrowers’ identities to prevent fraud attempts.

Accelerated and Audible Policy Processing

Route high volumes of inbound requests immediately to licensed agents. Manage multple channels in one interface – voice for discussing coverage details, recording concent, and taking First Notice of Loss claims, and WhatsApp for following up, sending payment reminders, and collecting documents.

Data-Driven Refinance Operations

Recognize key refinance signals (e.g., early payoff requests, eligibility changes, market rate movements) and route at-risk borrowers to dedicated refinance agents before they churn to competitors. Follow up with eligible customers, re-engage abandoned applications, and proactively present refinancing options. Use AI and customer data to identify which interactions are most likely to result in funded loans.

Ensure no time-critical calls and WhatsApp conversations (e.g., trade executions, order management, account access, trading restrictions) are delayed or disconnected. Prioritize high-net-worth clients and specialized inquiries by routing them to the right licensed broker. Use AI transcripts and sentiment analysis to flag forbidden phrases, potential coercion, or panic selling.

Reach more debtors without violating compliance regulations, time-zone restrictions, or frequency limitations. Segment accounts by delinquency stage and prioritize those with higher recovery probability. Offer self-service options, automations, and multi-channel payment reminders to increase collection rates and resolve cases independently.

Confirm loan terms, handle rollover and extention request, and resolve disbursement issues quickly and at scale. Proactively follow up on pending or failed payments via phone, WhatsApp, and SMS, and keep detailed records of every interaction, authorization, and disclosure. Identify borrowers’ identities to prevent fraud attempts.

Route high volumes of inbound requests immediately to licensed agents. Manage multple channels in one interface – voice for discussing coverage details, recording concent, and taking First Notice of Loss claims, and WhatsApp for following up, sending payment reminders, and collecting documents.

Recognize key refinance signals (e.g., early payoff requests, eligibility changes, market rate movements) and route at-risk borrowers to dedicated refinance agents before they churn to competitors. Follow up with eligible customers, re-engage abandoned applications, and proactively present refinancing options. Use AI and customer data to identify which interactions are most likely to result in funded loans.

Leverage powerful, intuitive, and hassle-free solutions

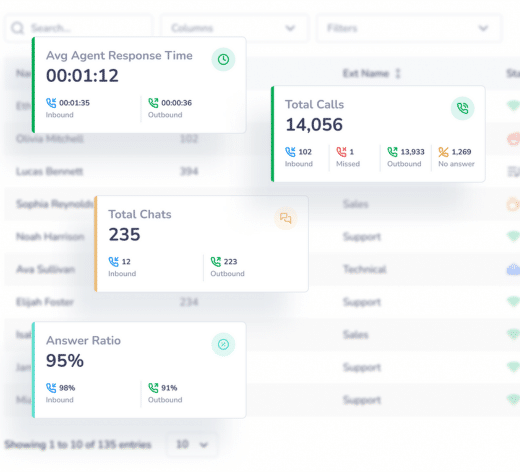

Quick setup, detailed onboarding, and intuitive interface shorten time to value, allowing you to focus on core financial processes.

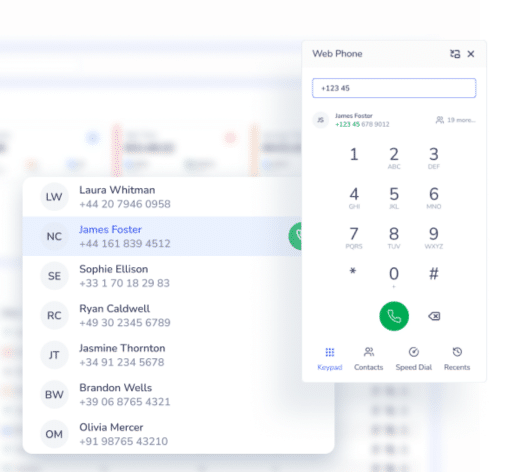

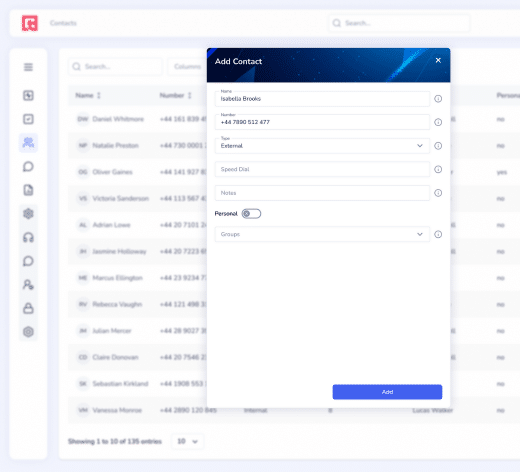

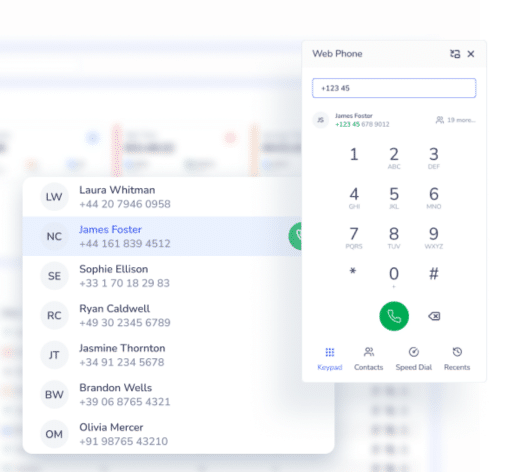

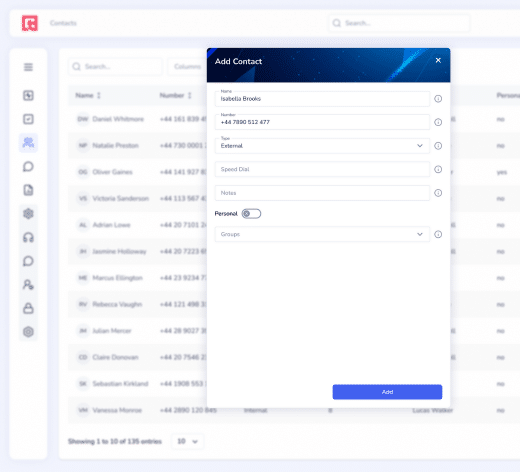

Keep voice, WhatsApp, and SMS interactions in a single hub, ensuring everything is logged, protected, and accessible in real time.

Utilize Two-Factor Authentication, role- and IP-based access, call encryption, call recording, and more to protect your customers and business.

Connect different branches, remote employees, and specialized agents with a secure, compliant, and cloud-based system.

Deployment timelines vary based on your specific requirements, but Squaretalk’s contact center solutions can be operational within a few business days, rather than the 12-18 months that traditional on-premises systems require. This often includes integration with your existing CRM, core banking systems, and compliance tools.

Squaretalk’s fast deployment means you can respond to market opportunities, regulatory changes, and competitive pressures without lengthy implementation delays.

Customer interactions are secured through encrypted voice and data, controlled role-based and custom access permissions, Lead ID for outbound agents, and forced password changes to reduce data exposure and compliance risks.

Yes. The Squaretalk platform enables secure work from anywhere with a stable Internet connection, allowing distributed teams to operate within a controlled, centralized, and auditable environment. We enforce strict IP allow-listing, role-based access, real-time monitoring, call recordings, audit trails, and more.

The platform is used by:

to manage secure, compliant, and high-volume customer interactions.

Our cloud-based platform allows your financial services to scale agent seats and channels up or down as demand changes or campaigns require it. AI voice agents, automation, routing logic, and real-time visibility minimize manual work during volume spikes and keep communication costs predictable. Providing customers with self-serve allows agents to focus only on complex or high-value cases, reducing the staff needed per interaction.

Join the Growing List of Success Stories

Get valuable AI-related insights